Lenovo to Acquire Controlling Stake of Fujitsu’s PC Business

by Anton Shilov on November 2, 2017 12:00 PM EST

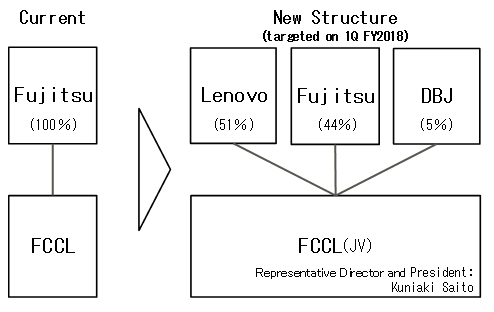

Lenovo, Fujitsu, and the Development Bank of Japan (DBJ) on Thursday announced plans to form a PC joint venture. Lenovo will own a 51% stake in the new venture – giving them the controlling stake of what is becoming of Fujitsu's PC business – while Fujitsu and DBJ will smaller stakes. The joint venture will develop, produce and sell computers under the Fujitsu brand to consumers, but Fujitsu will continue to serve its corporate customers through its channel partner network.

Fujitsu and Lenovo have been negotiating the deal for well over a year, so nothing comes as a surprise. Under the terms of the agreement, Fujitsu will sell a 51% stake in its wholly owned subsidiary Fujitsu Client Computing Limited (FCCL) to Lenovo and a 5% stake to DBJ. The former will pay up to ¥25.5 billion ($223.4 million), whereas the latter will pay up to ¥2.5 billion ($21.9 million) based on performance of FCCL to 2020. Initially, Lenovo will pay Fujitsu ¥17.85 billion ($156.42 million).

Lenovo is not new to joint ventures, particularly in Japan. Back in 2011, the company formed a joint PC business with NEC, where it owned a 51% stake. After five years, Lenovo acquired the remaining 49% stake from NEC to become the owner of the company, which controls about a quarter of the Japanese PC market. The takeover of the Fujitsu PC business was expected to increase Lenovo’s PC maker share in Japan to over 40%, but the actual share is unclear because Fujitsu will formally retain its corporate PC business.

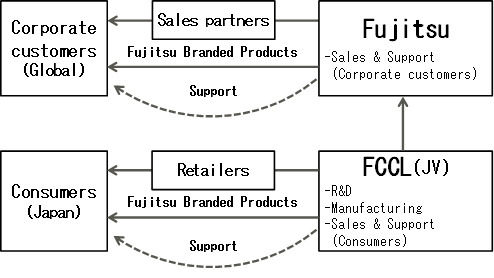

After the transaction closes in Q1 FY2018 (Q2 calendar 2018), FCCL will handle R&D, manufacturing, sales, and support of Fujitsu-branded PCs to consumers. The fact that FCCL will retain its “highly-automated and efficient manufacturing” means that Lenovo does not plan to move manufacturing of Fujitsu-branded devices to China, but will localize it in Japan, just like it did with NEC years ago. Obviously, Lenovo will procure parts required by FCCL and will therefore use its economies of scale to cut-down some of the manufacturing costs.

Meanwhile, Fujitsu will get the products from FCCL and will continue to serve as well as support its corporate customers either directly or indirectly worldwide. It is noteworthy that the statements from Fujitsu and Lenovo indicate that FCCL will only serve consumers in Japan and never mention Fujitsu’s PC business in Europe and North America. Fujitsu’s computers hardly command a tangible share of the market in either regions, but given the fact that Lenovo sells its computers under its own and local trademarks in Europe and the U.S., the future of Fujitsu-branded systems outside of Japan remains to be seen. In the meantime, PC giant will keep developing and selling separate PC lineups under Fujitsu, NEC, and Lenovo names in Japan.

Looking at the deal in general, it is noteworthy that in the recent quarters Lenovo lost its No. 1 position on the PC market to HP (1, 2, 3). IDC explains that Lenovo’s business was affected by weak sales in the U.S., so the acquisition may not necessarily help the Chinese PC company to regain its top spot. In the meantime, FCCL noted at the press conference in Tokyo that the Fujitsu brand is popular outside of the country of the rising sun (particularly in Europe), so keeping it on various markets might be a good idea in general.

Related Reading:

7 Comments

View All Comments

Daniel Egger - Thursday, November 2, 2017 - link

IBM, Motorola and now Fujitsu. Lenovo is killing great companies/branches and their products left and right...Samus - Thursday, November 2, 2017 - link

I agree. It'd be one thing if acquiring these companies made Lenovo shit better, but it seems they just make these other companies products worse.Hurr Durr - Friday, November 3, 2017 - link

IBM and Motorola were very successfully killing themselves. Hell, IBM still is!edzieba - Friday, November 3, 2017 - link

Motorola had a very brief period of non-decline under Google, but IBM-as-Lenovo has been going very well for them. The consumer lines are the same almost-universal garbage as before the acquisition (and as every other computer manufacturer), but the business lines remain excellent. I'd take a Thinkpad over a Latitude or Elitebook any day of the week.amosbatto - Sunday, November 5, 2017 - link

IBM PCs and Motorola under Google lost millions of dollars every quarter. I don't like some of the changes made by Lenovo, such as trying to make Thinkpads in 2013 (Tx30 series) look like Macbooks and taking away the removeable battery in smartphones and abandoning the X series smartphones, but Lenovo did make IBM's PC business profitable. It is still loosing money in its phone business, but less than Google lost, and LG, HTC, Sony and Microsoft are arguably doing worse than Lenovo in phones.Penti - Thursday, November 2, 2017 - link

Fujitsu PC's do command a market in Europe thanks to it's roots in Siemens PC-business, but I would say it's almost entirely in the enterprise space nowadays. Fujitsu Siemens had manufacturing in Germany and made some of their own notebooks (was responsible for designing some of Fujitsu's model-series) rather than just selling whatever Fujitsu came up with in Japan but I wouldn't count on them making a return in the retail/consumer space but rather continue to focus on businesses and public contracts here. Though stuff like their Lifebook-series (the one's with a docking-port at least) do compete against Lenovo's ThinkPads so I don't really know what the benefit would be for Lenovo to own and control the venture.They do still have manufacturing in Germany btw, but I don't really see how they could separate that from their server business. As they still engineer some of the PC systems in Germany/Europe I would think that it's a part of the joint venture. Don't know if the manufacturing plant will change hands, as that is part of the server business too and would make sense the keep within Fujitsu.

amosbatto - Sunday, November 5, 2017 - link

I remember reading a comment from Micheal Dell a couple years ago that there would eventually only be 3 PC companies. With Sony, Samsung, NEC and now Fujitsu all selling out or scaling back, there are fewer competitors than before. In 2016, the six leading companies (Lenovo, HP, Dell, Asus, Apple & Acer) controlled 76.1% of the global market. Every year, the total number of PCs being sold is reduced and the market share of the "others" is reduced.